Crypto

FintechZoom.com Asian Markets Today? A Daily Look with FintechZoom

The global financial landscape is a vast, interconnected network, and for many investors, keeping a pulse on every corner of it can feel like a Herculean task. While the American markets often dominate headlines, the burgeoning economies of Asia represent a significant and increasingly influential force. For those looking to diversify their portfolios or simply stay informed about this dynamic region, platforms like FintechZoom.com offer a valuable window into the daily movements of Asian markets.

FintechZoom.com positions itself as a comprehensive resource for market enthusiasts and investors, aiming to provide insightful analysis and real-time data across various financial instruments. While its primary focus might seem geared towards the U.S. stock market with deep dives into the Dow Jones, S&P 500, and Nasdaq, it crucially extends its reach to encompass the vital Asian and European markets. This broader scope is precisely what makes it a compelling tool for anyone interested in global economic trends.

Unpacking FintechZoom’s Asian Market Coverage

FintechZoom.com’s approach to Asian markets is multifaceted, offering a blend of real-time data, analytical tools, and educational content. Let’s delve into how it empowers users to navigate the complexities of this region.

Key Asian Indices Under the Microscope

A solid understanding of any market begins with its benchmark indices. FintechZoom.com provides dedicated coverage of several prominent Asian indices, offering users a snapshot of economic health and market sentiment in key regional players:

- Nikkei 225 (Japan): This widely recognized index tracks Japan’s top companies, serving as a critical barometer for the health of the Japanese economy. FintechZoom.com aims to deliver comprehensive data and insights into the Nikkei’s performance, helping investors understand the broader trends shaping one of Asia’s most developed markets. Factors influencing the Nikkei often include global trade relations, technological advancements, and domestic economic policies.

- Shanghai Composite Index (SSE) (China): As the world’s second-largest economy, China’s market movements are closely watched. FintechZoom.com’s coverage of the Shanghai Composite Index provides insights into the performance of A and B shares traded on the Shanghai Stock Exchange. Understanding this index is essential for gauging the stability and growth trajectory of the Chinese economy, which has a ripple effect across global supply chains and trade.

- Hang Seng Index (Hong Kong): The Hang Seng Index, representing major companies listed in Hong Kong, is another crucial indicator for the Asian financial landscape. Given Hong Kong’s unique position as a gateway to mainland China and a global financial hub, the Hang Seng provides valuable insights into regional investor confidence and the impact of geopolitical events. FintechZoom.com strives to deliver comprehensive data on these significant firms.

- NSE Nifty 50 Index (India): India’s economy is on a robust growth path, and the NSE Nifty 50, tracking 50 large-cap companies, offers a clear picture of its market dynamics. FintechZoom.com provides updates on this index, facilitating investors’ ability to monitor India’s expanding economy within the broader context of Asian and global markets. Factors such as domestic consumption, government reforms, and foreign investment flows heavily influence the Nifty 50.

- ASX 200 (Australia): While geographically distinct, Australia’s economy is deeply intertwined with Asia through trade and investment. The ASX 200, which tracks the top 200 companies listed on the Australian Securities Exchange, provides a vital snapshot of the Australian economy. FintechZoom.com’s inclusion of the ASX 200 rounds out its Asian market coverage, offering a more holistic view of the Asia-Pacific region.

The Power of Data and Analysis

FintechZoom.com’s value proposition extends beyond simply listing index numbers. The platform aims to equip users with the tools and information necessary for informed decision-making:

- Real-time Data and Updates: In today’s fast-paced markets, timely information is paramount. FintechZoom.com strives to deliver real-time stock quotes, interactive price charts, and continuous financial news updates. This immediate access allows investors to react swiftly to market shifts and identify emerging opportunities or risks.

- In-depth Financial Analysis: Beyond raw data, the platform offers detailed analysis of various stocks and sectors within Asian markets. This often includes breakdowns of earnings reports, revenue trends, and key financial metrics. Such in-depth insights help users understand the underlying health and prospects of individual companies and broader industries.

- Advanced Charting Tools: Visualizing market data can significantly enhance understanding. FintechZoom.com provides advanced charting tools that allow users to customize charts, apply various technical indicators, and analyze historical price movements. This empowers both novice and experienced traders to identify patterns and potential entry or exit points.

- Historical Data and Performance Metrics: To truly understand market cycles and long-term trends, historical data is indispensable. FintechZoom.com aims to offer extensive historical data and performance metrics for Asian indices and individual stocks, enabling investors to conduct thorough backtesting and assess long-term viability.

- Market Sentiment and News Aggregation: Market sentiment, often driven by news and prevailing narratives, plays a significant role in price action. FintechZoom.com endeavors to aggregate news articles, analyst ratings, and even social media sentiment, providing a more holistic view of how the market feels about specific assets or the overall economic outlook in Asia.

- Educational Resources: For those new to investing or looking to deepen their knowledge, FintechZoom.com also offers educational resources. These might include articles, tutorials, and webinars that cover fundamental investment principles, technical analysis strategies, and general market dynamics. This commitment to education helps democratize financial knowledge and empowers users to make more confident decisions.

A Glimpse at Asian Markets Today (June 19, 2025)

As of today, June 19, 2025, the performance across Asian markets presents a mixed picture, reflecting the nuanced interplay of global economic factors and regional developments. While specific, minute-by-minute data would require a live visit to FintechZoom.com’s platform, general trends from reliable financial news sources indicate:

- Japan’s Nikkei 225 has shown a decline today, suggesting some downward pressure on Japanese equities. This could be influenced by a variety of factors, including global interest rate expectations, commodity price fluctuations, or specific domestic economic data releases.

- Hong Kong’s Hang Seng Index is also exhibiting a decline. The Hong Kong market is often sensitive to geopolitical developments, global economic slowdown concerns, and, of course, mainland Chinese market performance.

- In mainland China, the Shanghai Composite Index (SSE) is showing a slight gain. This resilience might be attributed to targeted government stimulus measures, positive economic data, or a shift in investor sentiment towards domestic growth prospects.

- India’s NSE Nifty 50 Index is experiencing a slight decline. Indian markets have seen significant volatility recently, often reacting to global cues, inflation concerns, and domestic policy announcements.

- Other key Asian markets, such as South Korea’s KOSPI, are generally seeing declines, while indices in countries like Indonesia, Malaysia, and Thailand are also displaying varied movements, with a leaning towards slight dips.

It is crucial for investors to remember that market movements are dynamic and influenced by a multitude of interconnected factors, including global interest rates, inflation expectations, geopolitical events, commodity prices, and corporate earnings reports. Therefore, a comprehensive platform like FintechZoom.com becomes invaluable for real-time monitoring and informed analysis.

Why Asian Markets Matter

Investing in or simply understanding Asian markets is no longer an optional endeavor for those seeking a holistic view of the global economy. Here’s why this region is so significant:

- Economic Powerhouses: Countries like China, Japan, and India are economic giants, with substantial contributions to global GDP and trade. Their growth trajectories and market performance have significant implications for international commerce and investment.

- Diversification Opportunities: For investors primarily focused on Western markets, Asian equities offer valuable diversification benefits. Different economic cycles, industry strengths, and geopolitical factors can lead to uncorrelated returns, potentially reducing overall portfolio risk.

- Innovation Hubs: Asia is rapidly emerging as a global leader in technological innovation, from artificial intelligence and fintech to renewable energy and e-commerce. Investing in this region can provide exposure to cutting-edge companies and disruptive technologies.

- Demographic Dividend: Many Asian nations benefit from large, young, and increasingly affluent populations, driving domestic consumption and long-term economic growth. This demographic dividend presents unique investment opportunities in sectors catering to rising consumer demand.

- Global Supply Chains: Asia is the manufacturing hub of the world. Understanding its economic health and market stability is crucial for businesses and investors globally, as disruptions in Asian supply chains can have far-reaching consequences.

The FintechZoom.com Advantage for Asian Markets

In a world brimming with financial data, what makes FintechZoom.com a compelling choice for monitoring Asian markets?

- Consolidated Information: Instead of jumping between multiple news sources and data providers, FintechZoom.com aims to consolidate essential information, offering a streamlined experience for users.

- User-Friendly Interface: The platform emphasizes a user-friendly interface, making complex financial data accessible even to those who are not seasoned market professionals. This ease of navigation is vital for quick analysis.

- Analytical Depth: While offering broad coverage, FintechZoom.com also delves into analytical depth, providing insights that go beyond surface-level data. This allows for a more nuanced understanding of market drivers.

- Global Perspective: By integrating Asian market data with its extensive coverage of U.S. and European markets, FintechZoom.com enables users to gain a truly global perspective, understanding how different regions influence each other.

However, as with any platform, it’s always wise to complement the information gathered from FintechZoom.com with other reputable financial news outlets and research reports. A diversified approach to information gathering ensures a well-rounded and accurate understanding of the market landscape.

Conclusion

The Asian markets are a vibrant and indispensable component of the global financial ecosystem. For investors and enthusiasts alike, staying informed about their daily fluctuations, underlying trends, and influential factors is paramount. FintechZoom.com serves as a valuable gateway to this dynamic region, offering a blend of real-time data, analytical tools, and educational resources designed to empower users with the knowledge needed to navigate these exciting markets. Whether you’re tracking the technological advancements in Japan, the economic shifts in China, the growth story of India, or the broader movements across the Asia-Pacific, FintechZoom.com aims to be your trusted companion in understanding “Asian markets today.”

10 Frequently Asked Questions about FintechZoom.com and Asian Markets

1. What exactly is FintechZoom.com? FintechZoom.com is a financial technology platform that provides news, analysis, and real-time data across various global financial markets, including a significant focus on Asian, European, and U.S. equities. Its goal is to offer comprehensive insights for investors and market enthusiasts.

2. Does FintechZoom.com only cover U.S. markets, or does it genuinely focus on Asian markets too? While FintechZoom.com provides extensive coverage of U.S. markets like the Dow Jones, S&P 500, and Nasdaq, it explicitly states that it also offers substantial and comprehensive information on Asian and European markets, recognizing their importance for global diversification.

3. Which specific Asian stock indices does FintechZoom.com provide data on? FintechZoom.com covers key Asian indices such as the Nikkei 225 (Japan), Shanghai Composite Index (China), Hang Seng Index (Hong Kong), NSE Nifty 50 Index (India), and the ASX 200 (Australia).

4. What kind of real-time data can I expect for Asian markets on FintechZoom.com? You can expect real-time stock quotes, interactive price charts, and continuous financial news updates for various Asian stocks and indices, allowing for timely reactions to market changes.

5. Are there any analytical tools available on FintechZoom.com for Asian market investors? Yes, FintechZoom.com aims to provide in-depth financial analysis, advanced charting tools for technical analysis, historical data, and performance metrics to help investors understand market trends and make informed decisions.

6. How does FintechZoom.com help in understanding market sentiment in Asia? FintechZoom.com endeavors to aggregate news articles, analyst ratings, and social media sentiment related to Asian markets, helping users gauge the prevailing mood and narratives that can influence market movements.

7. Does FintechZoom.com offer educational resources for those new to Asian market investing? Yes, the platform offers educational resources such as articles, tutorials, and potentially webinars on investment principles and strategies, making it easier for users to learn about the complexities of Asian markets.

8. Is the information on FintechZoom.com reliable for making investment decisions? FintechZoom.com strives to provide accurate and informative content based on reliable sources. However, it’s always recommended to use FintechZoom.com as one of several resources and to conduct your own thorough research before making any investment decisions. Markets are inherently unpredictable.

9. Why are Asian markets so important for global investors? Asian markets are crucial due to their significant economic contributions, offering diversification benefits, acting as innovation hubs, benefiting from strong demographic trends, and being central to global supply chains. Their performance has far-reaching implications worldwide.

10. What makes FintechZoom.com stand out for Asian market coverage? FintechZoom.com aims to stand out by providing consolidated and user-friendly information, offering analytical depth, and presenting a global perspective that connects Asian market movements with broader international trends, all designed to make complex financial data more accessible.

Click for more amazing info. News MM

Crypto

Earn 1$ per claim highest paying faucet no minimum withdraw 2025

Introduction

Have you ever heard of a crypto faucet? Simply put, it’s an online platform that rewards users with small amounts of cryptocurrency for doing simple tasks. The word “faucet” is used because it “drips” tiny amounts of crypto over time.

In this article, we will explore how crypto faucets work, their benefits and risks, how you might aim to earn “$1 per claim” (or at least something close) with a high paying faucet and no minimum withdrawal in 2025, and important tips to stay safe. Let’s get started in a friendly and easy to understand way.

What is a Crypto Faucet?

A crypto faucet is a website or app that gives you a small amount of cryptocurrency for completing simple tasks. These tasks might include solving a captcha, watching a short video, clicking a link, or completing a survey.

The idea is that you don’t invest any money to get started; you just spend time doing tasks and in return, you receive some crypto. Because the amounts are small, this is more of a beginner’s tool to learn about crypto rather than a full income stream.

Originally, the first crypto faucet created in 2010 gave away 5 BTC per user to help promote adoption of Bitcoin.

How Do Faucets Work?

Let’s break the process down into simple steps:

- Choose a Faucet Platform – You pick a website or app that offers crypto for tasks.

- Register (or Provide Wallet Address) – You may need to sign up or at least enter your wallet address where the crypto will be sent.

- Complete Tasks – These tasks are usually very easy: solving captchas, watching ads, clicking links, doing quizzes, maybe playing small games.

- Receive Reward – After you complete the task, you get a small amount of crypto sent to your wallet.

- Accumulate and Withdraw – You collect small rewards over time until you reach a threshold (if there’s a minimum) or you choose to withdraw. Then you transfer to your main wallet or exchange.

Here is a key point: the rewards are small, so it may take many tasks to build up something meaningful.

Also note: Some faucets are simply educational or testnet faucets (distributing tokens with no major value) rather than high value ones.

Why Do Crypto Faucets Exist?

There are a few motivations behind faucets:

- User Onboarding: They help beginners get a taste of cryptocurrency without investing money. You learn how wallets work, how to claim and transfer tokens.

- Marketing & Adoption: For a new cryptocurrency or blockchain, giving small rewards helps spread the word and get users engaged.

- Revenue Model: Many faucets earn money via ads or affiliate links; they share a small part of that revenue with users as crypto rewards.

- Testnet / Developer Tools: In some cases, faucets give free tokens on test networks to allow developers to test smart contracts or applications without spending real money.

What Does “$1 Per Claim” and “No Minimum Withdraw” Mean?

In some promotional offers, a faucet might claim that each time you “claim” (i.e., complete a task) you can earn up to $1 worth of cryptocurrency. The “no minimum withdraw” promise means that you can transfer your rewards to your wallet without needing to reach a large threshold first. In practice, however, this is rare and needs careful checking.

Important caveats:

- Earning $1 per claim is an optimistic scenario. Most faucets pay far less per task.

- “No minimum withdraw” may hide conditions like high withdrawal fees, only certain coins supported, or long waiting times.

- The value of crypto fluctuates: $1 worth today might be less tomorrow.

- Always check the legitimacy: large payout promises can sometimes indicate higher risk.

So while the title “Earn 1$ per claim highest paying faucet no minimum withdraw 2025” is attractive, you must research any faucet claiming this and manage realistic expectations.

Benefits of Using Crypto Faucets

Here are some of the upside points:

- Low barrier to entry: You don’t need money to start; you just spend time.

- Learning opportunity: Especially useful for beginners to understand how crypto wallets, addresses and transfers work.

- Safe (mostly) from financial loss: Since you’re not investing money, the financial risk is low.

- Try new coins: You may get exposure to smaller altcoins or tokens you wouldn’t normally buy.

- Potential to accumulate value: While small, if you are consistent, you might accumulate a meaningful amount over time.

Risks and Limitations

Now the reality check, every opportunity has trade offs.

- Very low earnings: Many faucets pay very small amounts, maybe a few cents or less per task. You may spend a lot of time for small return.

- Time vs reward: The time spent may not match the value earned. If your time is valuable, the return may be poor.

- Scams and fraudulent sites: Some faucets may not pay out, or might collect your data and expose you to spam or phishing.

- Privacy concerns: You may need to provide email, wallet address, or other data. Some sites may sell or misuse that.

- High withdrawal thresholds or fees: Even if no minimum is advertised, actual conditions may make withdrawal difficult or expensive.

- Testnet tokens or coins with little value: Some faucets give tokens that are not very useful or liquid.

How to Choose and Use a Good Faucet (2025 Tips)

If you decide to try a crypto faucet, here are some friendly tips to stay safe and make the most of it.

- Research the faucet: Read reviews, check crypto forums, see if users have been paid.

- Check payout terms: Confirm the coin, minimum (if any), withdrawal fees, how often you can claim.

- Use a dedicated wallet or burner wallet: Especially if you’re entering an unknown site. Don’t mix with your main holdings.

- Protect your personal information: Don’t share private keys or sensitive details. Use unique passwords.

- Balance your time: If a faucet pays very little and takes much time, you may want to move to something else.

- Avoid unrealistic promises: “$1 per claim for free no wait” may sound too good to be true; it may carry hidden conditions or risk.

- Cash out when possible: If you accumulate something, withdraw when you meet safe conditions, rather than leaving it indefinitely.

- Use trusted coins: If possible, choose faucets that pay in well known crypto rather than obscure coins you cannot easily convert.

- Stay aware of security risks: Be cautious of pop ups, ads, or apps that ask for too much permission.

- Use the experience to learn: Even if earnings are small, you can learn about how crypto works, which can be valuable.

Can You Really Earn $1 per Claim?

Technically, yes, some faucets may offer high rewards under specific conditions or for heavy effort. But realistically:

- Most faucets pay much less than $1 per claim.

- To reach $1, you may need to do more work, wait longer, or hit special promotions.

- “No minimum withdraw” may be advertised, but you’ll want to check that you can actually transfer that amount easily and it is not locked or inflated by fees.

- In the current landscape of 2025, many faucets have shifted to lower payouts and focus on testing, learning, or onboarding rather than high income.

Therefore, use bold promises as a signal to dig deeper, not as a guarantee.

Summary

Crypto faucets are a friendly entry point into the world of cryptocurrency. They allow you to earn small amounts of crypto by doing easy tasks, which can help you learn how wallets and blockchains operate with little financial risk. But the reality is that the rewards are typically small, the time investment may not match the payoff, and you must guard against scams or unrealistic expectations.

If you go into it with the mindset of learning, rather than expecting large earnings, you will be better positioned to benefit. If you aim for something like “$1 per claim” and “no minimum withdraw,” carefully check the terms, protect your wallet, and stay realistic. Use it as one tool in your crypto journey, not a full income solution.

Frequently Asked Questions

- What exactly is a crypto faucet?

A crypto faucet is a website or app that gives you a small amount of cryptocurrency for finishing simple tasks like watching ads or solving captchas. - Do I need to spend money to use a crypto faucet?

Generally no, you don’t need to invest money. The tasks are free and the reward comes from the faucet’s ad or affiliate revenue. - Can I earn real money from a faucet?

Yes, you can earn real crypto, which you may convert into fiat money. But the amounts are usually very small, so the earnings may also be very low. - What does “no minimum withdraw” mean?

It means you can transfer your earnings out of the faucet without needing to reach a large threshold amount. But always check for hidden fees or conditions. - Is it safe to use crypto faucets?

It can be safe if you pick reputable faucets, protect your wallet information, and avoid platforms showing too many red flags. But there are risks like phishing, data harvesting, or non payment. - How much time will it take to earn something meaningful?

It depends on the faucet, the tasks, and how many you do. Because payouts are small, you might need many tasks or a long time to accumulate something worthwhile. - Can faucets replace a regular income?

Unlikely. Since rewards are small and time investment can be significant, faucets are better as learning tools or side activities rather than a main income. - What should I look for when choosing a good faucet?

Look for user reviews, transparent payout terms, reasonable withdrawal conditions, support for known crypto, and minimal risk to your personal data or wallet. - What are testnet tokens and why are they used?

Testnet tokens are coins distributed on test networks used for development, not for real money. Some faucets give these to let users practice without risk. They usually have little or no real world value. - What are the main pitfalls to avoid?

- Promises that sound too good (e.g., guaranteed $1 per claim without conditions)

- Sites asking for private keys or too much personal data

- Sites that never pay out or have hidden fees

- Time investment outpacing the reward

- Not protecting your wallet or mixing faucet rewards with your main holdings

Click for more amazing info. News MM

Crypto

Crypto30x.com Review: Is It Safe or a Scam? Simple Guide for Beginners (2025)

Quick summary

Crypto30x.com presents itself as a crypto site focused on market news, ideas, and trading-style content. On its homepage, it says it is a “go-to destination” for crypto news, reviews, and appraisals.

In this review, you will learn what the site claims to offer, the main risks for new users, and how to check if any crypto platform is safe before you share money or data. We will use guidance from trusted sources like the CFTC, FCA, FTC, and NFA, and we will keep the language simple and clear.

What is Crypto30x.com?

According to its own website, Crypto30x.com publishes crypto market content. It frames itself as a hub for “news reviews” and analysis for people who follow digital assets. It does not clearly show public company info, team names, or licenses on the homepage. Because of this, beginners should treat it as unverified until they confirm who runs it and what services (if any) it actually provides.

Tip: Any website can describe itself in a positive way. Always confirm claims using neutral sources and official registers.

Are there clear licenses or registrations?

Rules depend on the country and on what a service actually does. For example:

- United States (derivatives, margin, or leveraged products): the CFTC says you should check a firm in NFA BASIC to confirm registration and see any history before you trade.

- United Kingdom (crypto activities in scope of AML rules): the FCA says most firms must be authorised or registered if they offer covered crypto services to UK users. You can use its checker and warning list.

At the time of writing (November 9, 2025), I did not find independent, official records about Crypto30x.com on public regulator pages. That does not prove it is illegal; it only means you should do your own checks directly in the registers above, and avoid sending funds until you know the legal entity, country, and approvals. The links above show you where to look.

Main risks you should know (in simple words)

1) Leverage and margin risk

If a platform offers margin or leverage (for example “30×”), gains and losses move much faster. Even a small price move can wipe out your balance. The CFTC explains that leverage amplifies risk and can lead to big losses quickly.

2) Lack of strong protections on many crypto sites

The CFTC also warns that many cash crypto markets are not supervised like stock exchanges. That means there may be fewer customer protections, more price swings, and higher cyber risk.

3) Unregistered or offshore dealers

The CFTC reports many complaints about people who wired money to unregistered offshore dealers after seeing social posts. Later, they could not withdraw, or were asked to pay more fees. If a site is not registered where it should be, that is a red flag.

4) “High return, low risk” promises

Regulators warn about websites or groups that push “guaranteed” gains or very high returns from special crypto strategies. Be extra careful with any site using this style of pitch.

5) Platform failure and custody risk

History shows that even big exchanges can fail. When FTX collapsed, a U.S. court later ordered billions in relief for customers; many people could not access funds for a long time. This is a reminder to be cautious with all platforms, big or small.

What we can confirm today

- What the site says: Crypto30x.com describes itself as a place for crypto news, reviews, and analysis. It does not provide clear public licensing details on its homepage.

- Independent coverage: There is little coverage in major, trusted media or by regulators about this exact site. That does not prove anything on its own, but it means you need to be careful and do extra checks.

How to check any crypto platform (a simple checklist)

Use this step-by-step list before you sign up or send money:

- Find the legal entity

Look for a real company name, a physical address, and team members you can verify. If the site has only a brand name and no legal entity, stop and ask support for details. - Check official registers

- If the service deals with leverage, margin, or derivatives for U.S. users, search the NFA BASIC database and confirm CFTC or NFA status.

- If you are in the UK, use the FCA registers and warning list.

- Look for risk warnings

Real platforms show clear, specific risk warnings, especially if they offer leverage. Compare their language with the CFTC’s general advisories about virtual currency risk. If the site’s warning is missing or vague, that is a sign to pause. - Search for scams and complaints

The FTC advises you to search the site or company name plus “review,” “scam,” and “complaint” before you invest. This basic step can save you a lot of pain. - Test withdrawals with tiny amounts

If you still choose to try a platform, start with a very small amount and test a withdrawal quickly. Do not add more until you prove you can get your money out in a normal time. - Use strong security

Turn on 2-factor authentication. Never share your private keys. Keep most assets in your own wallet if you can. Regulators list cyber risks as a major issue for crypto users.

Does Crypto30x.com look safe for beginners?

Right now, I see uncertainty in three areas that matter for new users:

- Transparency: On the homepage there is no clear legal entity, team page, or license info. That makes it harder to judge accountability.

- Regulatory status: I did not find independent listings in the main public registers. You should run your own checks in NFA BASIC and the FCA to be sure.

- Leverage messaging: If you see any claim or content around “30×” or other high-risk tactics, remember that leverage can increase losses very fast. Beginners should avoid leverage until they fully understand it.

For a beginner who wants simple, low-stress exposure to crypto, a news or review site alone is not enough. If you plan to trade, choose a platform that is clearly regulated in your country, has a long public history, and has strong external audits and clear withdrawal records.

Practical safety tips (B1 level)

- Stay skeptical of big promises. If it sounds too good to be true, it probably is. Regulators warn that scammers often use big claims to attract victims.

- Check the name in official sites. Use NFA BASIC (U.S.) and FCA (UK). If you cannot find the company, be careful.

- Start small and test withdrawals. Do not send large amounts at first.

- Protect your accounts. Use strong passwords and 2FA. Keep most funds in your own wallet.

- Avoid pressure. If someone pushes you to “act now,” walk away. The FTC warns that many crypto scams start with social DMs or unexpected messages.

Verdict

Crypto30x.com markets itself as a place for crypto news and analysis. That can be useful for learning. But for new investors, the lack of clear public licensing info and the general risks around leverage and unregulated platforms mean you should move slowly, double-check everything, and never invest more than you can afford to lose. Use the official registers and safety guides linked above.

Frequently Asked Questions (FAQs)

- Is Crypto30x.com a trading platform or a news site?

Based on its homepage text, it presents itself as a hub for news, reviews, and analysis. It does not clearly show licenses on the homepage. Always verify what service is actually provided before you sign up. - Is Crypto30x.com regulated?

I did not find public regulator listings for this site. You should check the NFA BASIC database (U.S.) and the FCA registers (UK) yourself to confirm status before using any service. - What is the biggest risk for a beginner?

Leverage. It can multiply losses very fast. The CFTC explains how leverage amplifies risk. - How do I verify a company in the U.S.?

Go to NFA BASIC, search by firm name or NFA ID, and confirm registration and any actions. - How do I verify a company in the UK?

Use the FCA firm checker and warning list to see if a company is authorised or registered. - What are signs of a scam I should watch for?

Guaranteed returns, pressure to deposit fast, problems withdrawing, or requests to pay “extra fees” to release funds. The CFTC and FTC warn about these patterns. - Can big exchanges fail too?

Yes. The FTX case shows that even large platforms can collapse and lock funds for long periods. - What is a safe way to test a new platform?

If you still want to try it, start with a very small amount, enable 2FA, and test a withdrawal quickly. The CFTC lists cyber and platform risks for crypto users. - Where can I learn more about crypto risks from official sources?

Read the CFTC’s “Understand the Risks of Virtual Currency Trading” advisory. It covers volatility, platform safeguards, and more. - I got an unexpected message telling me to invest via a link to Crypto30x.com. What should I do?

Be careful. The FTC says many crypto scams start with unexpected DMs, social posts, or dating app messages. Do not send money. Report it if needed.

Click for more amazing info. News MM

Crypto

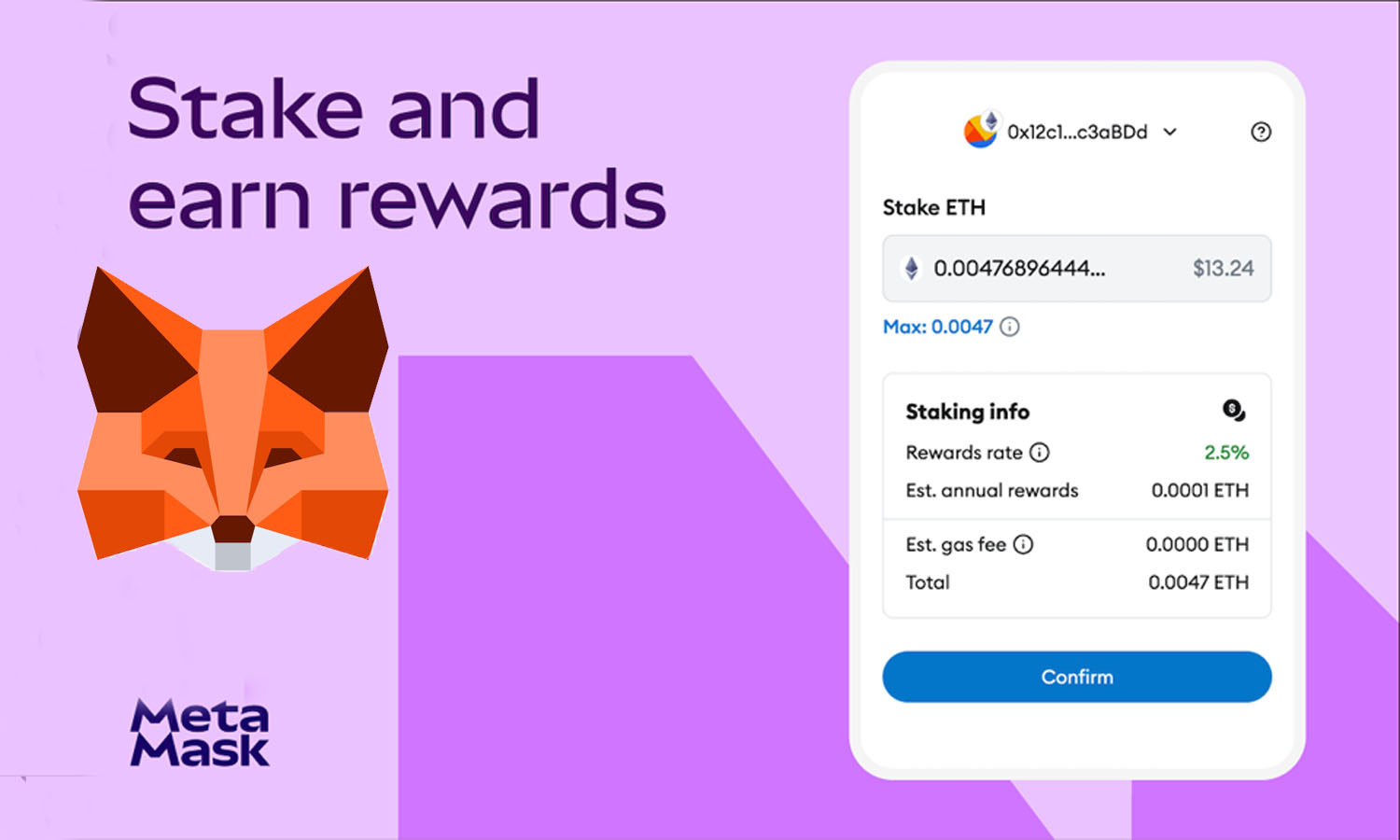

Download MetaMask Tumb Safely: Everything You Need to Know in 2025

In the ever-evolving world of cryptocurrency, security and privacy have become top priorities for users navigating digital wallets and decentralized apps. One tool that’s garnered curiosity and attention recently is the so-called “MetaMask Tumb.” While it may sound like a new product from the MetaMask ecosystem, it’s more of a concept or unofficial term linked to enhancing privacy in crypto transactions.

What is MetaMask?

MetaMask is a well-established and widely-used cryptocurrency wallet. It allows users to store, manage, and exchange Ethereum and other ERC-20 tokens. Originally developed as a browser extension, it has now expanded into a mobile app available on iOS and Android.

Some of the key features of MetaMask include:

- Decentralized access to Ethereum-based apps (dApps)

- Secure key management and token storage

- Simple token swapping functionality

- Cross-platform availability for seamless integration

With over 30 million users worldwide, MetaMask plays a vital role in DeFi, NFTs, and Web3 development.

Decoding the Term “MetaMask Tumb”

There is no official product from MetaMask called “MetaMask Tumb.” So, where does the term come from?

“Tumb” appears to be a shorthand or possible typo for “tumbler” — a term used in cryptocurrency circles to describe tools that mix or obscure transaction trails. These are often called “mixers” or “tumblers” and are used to enhance user privacy by blending multiple transactions together to make it difficult to trace where the crypto came from or went.

In that context, “MetaMask Tumb” likely refers to a conceptual or unofficial idea of integrating tumbling capabilities into MetaMask, or using MetaMask in conjunction with third-party privacy tools.

Can You Use Tumblers with MetaMask?

Yes, but with caution.

MetaMask itself does not offer built-in tumbling or mixing features. However, some privacy-centric platforms or decentralized apps (dApps) can be connected to MetaMask to enable anonymous transactions. These tools typically:

- Route transactions through multiple addresses

- Randomize transaction amounts and timing

- Obscure wallet addresses to protect user identity

Examples of tumblers and privacy tools that users may connect with MetaMask include Tornado Cash (now restricted in many jurisdictions), Railgun, and Wasabi Wallet (for Bitcoin).

Keep in mind that using such tools may come with legal implications depending on your country. Always check local regulations before using any kind of crypto anonymization service.

How to Safely Download MetaMask in 2025

Before even thinking about privacy tools or tumblers, it’s important to get MetaMask from the right place. Here’s a step-by-step guide for downloading MetaMask safely:

1. Visit the Official MetaMask Website

Go to https://metamask.io — this is the only legitimate source for downloading MetaMask. Any third-party sites offering MetaMask downloads should be treated as suspicious.

2. Choose the Right Platform

MetaMask supports the following:

- Browser Extensions: Chrome, Firefox, Brave, and Edge

- Mobile Apps: iOS (App Store) and Android (Google Play)

Select your platform and click the corresponding download link.

3. Install & Verify

After installation, check that the extension or app is published by “MetaMask” or “ConsenSys“. Fake versions often mimic the design but may steal user data.

Tips for Staying Safe with MetaMask and Privacy Tools

Using MetaMask with or without privacy enhancements should always follow best security practices:

- Never share your seed phrase – even with someone claiming to be tech support.

- Enable biometric authentication on mobile for added protection.

- Beware of phishing websites that look like MetaMask but are designed to steal your login credentials.

- Don’t install unknown browser extensions or apps that claim to offer tumbling services.

- Only interact with verified and trusted dApps when connecting MetaMask.

Why Privacy Matters in Crypto

The rise of blockchain transparency, while a strength, can also be a downside for users who prefer discretion. Even though addresses are pseudonymous, they can be linked back to individuals through patterns, exchanges, or social behavior.

That’s where tumbling or mixing comes in — it adds a layer of anonymity, allowing users to obscure the origin or destination of funds. However, this power must be used responsibly, and MetaMask users must ensure that privacy doesn’t come at the cost of security or legality.

Is “MetaMask Tumb” Safe to Use?

Because “MetaMask Tumb” isn’t an official service, the term is ambiguous and could be used by malicious actors to mislead users into downloading fake apps or browser extensions. If you see a platform or file claiming to be “MetaMask Tumb,” do not install it unless it’s officially endorsed by MetaMask or thoroughly vetted.

Stick to trusted dApps and privacy tools that have undergone security audits and have open-source code.

Final Thoughts

MetaMask continues to be one of the most trusted wallets in the crypto space. While privacy tools and transaction mixers are gaining traction, users must be extremely cautious when exploring such options. “MetaMask Tumb” may be a misunderstood or unofficial concept, but it underscores a growing interest in privacy within the decentralized finance world.

Frequently Asked Questions (FAQs)

1. What is MetaMask Tumb?

MetaMask Tumb is not an official tool — it likely refers to using MetaMask in conjunction with crypto tumblers for enhanced privacy.

2. Is it safe to download MetaMask Tumb?

There is no official download for MetaMask Tumb. Only download MetaMask from its official website to stay safe.

3. Can I use MetaMask with tumblers?

Yes, MetaMask can connect to dApps that offer tumbling or mixing services, though users should proceed with caution.

4. Are crypto tumblers legal?

The legality of tumblers varies by country. In some regions, they are restricted due to their association with money laundering.

5. How can I ensure my MetaMask is real?

Download only from metamask.io and check publisher details to confirm authenticity.

6. What are the risks of using privacy tools with MetaMask?

Risks include potential scams, legal issues, and exposure to malicious contracts if not used carefully.

7. Is there a mobile version of MetaMask?

Yes, MetaMask is available on both iOS and Android mobile platforms.

8. What is a crypto tumbler used for?

A crypto tumbler mixes crypto transactions to make them more anonymous and harder to trace.

9. Does MetaMask support Bitcoin?

MetaMask is primarily built for Ethereum and ERC-20 tokens. It does not natively support Bitcoin.

10. Can I trust dApps offering MetaMask tumbling?

Only trust well-reviewed and audited dApps. Be wary of unknown platforms using the term “MetaMask Tumb.”

Click for more amazing info. News MM

-

Celebrity10 months ago

Celebrity10 months agoIndia Rose Brittenham: All You Need to Know About Heather Thomas’ Daughter

-

Celebrity10 months ago

Celebrity10 months agoMargot Rooker: All You Need to Know About Michael Rooker’s Wife

-

Celebrity10 months ago

Celebrity10 months agoRobert Noah? All You Need to Know About Trevor Noah’s Father

-

Celebrity10 months ago

Celebrity10 months agoNadia Farmiga? All You Need to Know About Taissa Farmiga’s Sister

-

Celebrity10 months ago

Celebrity10 months agoJackie Witte? All You Need to Know About Paul Newman’s First Wife

-

Celebrity10 months ago

Celebrity10 months agoCheryl Pistono? All You Need to Know About Kareem Abdul-Jabbar’s Ex-Girlfriend

-

Celebrity9 months ago

Celebrity9 months agoWho is the Father of Jay-Z? Biography of Adnis Reeves

-

Celebrity10 months ago

Celebrity10 months agoAbigail S. Koppel? All You Need to Know About Leslie Wexner’s Wife